Guest post by Jean Adams, Centre for Diet & Activity Research (CEDAR), University of Cambridge

Mostly you don’t get to watch TV at work. The day that George Osborne announced he would introduce a tax on sugary drinks in the UK, here at CEDAR HQ we all stood huddled around a computer monitor watching and re-watching the words coming out of his mouth.

Oh. My. Goodness. I did not see that coming.

|

The “soft drinks industry levy”, to give it it’s proper name.

|

A rather senior professor has since told me that he totally saw it coming.

After we’d got over the shock of the announcement, the conversation turned pretty quickly to research (well, this is a university, after all). We have got to evaluate this!

Colleagues at CEDAR had already written

papers about how sugary drink taxes could be evaluated. We had talked with colleagues in other countries about evaluating their taxes – only for those taxes to fall through at the final political hurdle. I have more than one half-written application for research funds to evaluate sugary drink taxes stashed down the back of my computer.

And here it was, all systems go for designing an evaluation for a UK sugary drinks tax! In our back yard!

OK, so we have to work out whether it impacts on diet. But, what about jobs? Will people lose their jobs? Surely we need to know if it changes price and purchasing of sugary drinks. Right, but even if it does people might just shift to other foods – maybe they will just eat more cake instead? We are Public Health researchers, we need to focus on health: does the tax change how many people get diabetes? Or tooth decay? Or the number of obese children? And what about how this even happened? Did you see it coming? Why has this happened? Why now? Why don’t we do interviews with politicians and find out how it happened?

Woah, woah, woah! Ten seconds in and this is getting way more complicated than we (I) had ever thought it might. Before we did anything, we needed to work out what we thought might be going on here. Once we understood what the potential impacts might be, then we could start thinking about how we might evaluate them.

So that’s what we did. We spent 6 months developing a ‘systems map’ of the potential health-related impacts of the UK

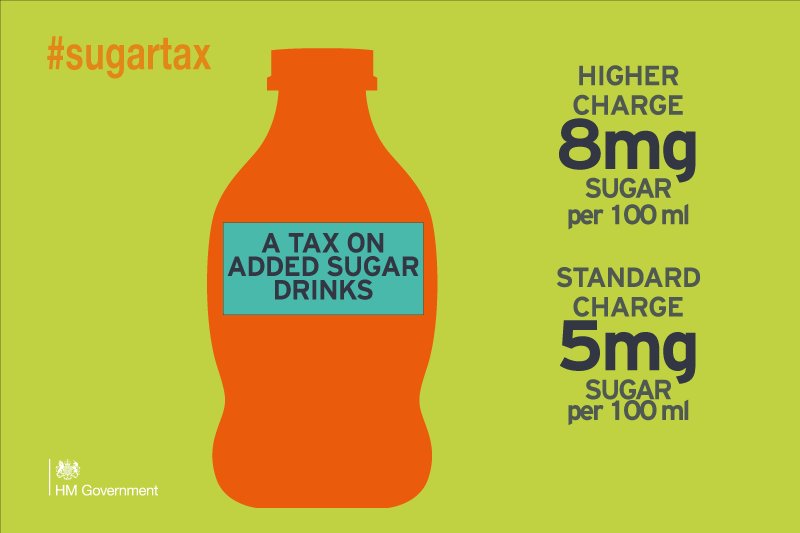

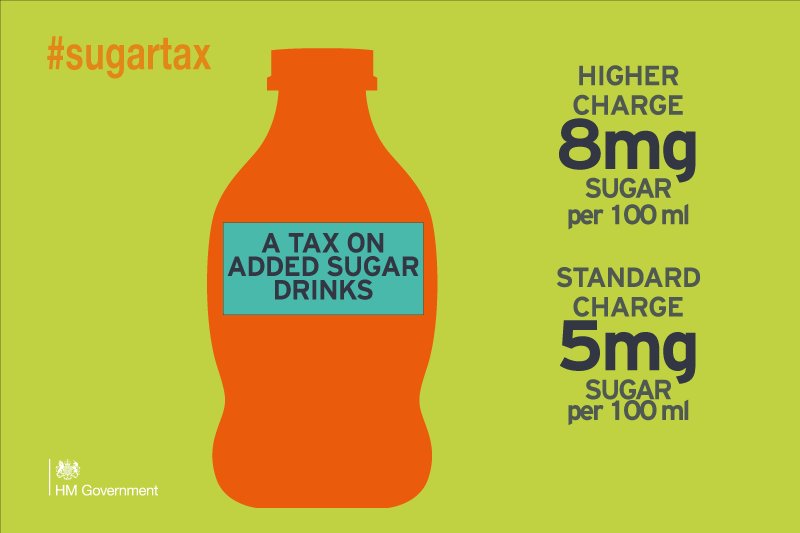

Soft Drinks Industry Levy (aka sugary drinks tax). The tax is explicitly designed to encourage soft drinks’ manufacturers to take sugar out of their drinks. There are two levels – a higher tax for drinks with the most sugar, a lower one for only moderately sugary drinks. So we started there (at ‘reformulation’) and worked out.

Then we sense-checked our map with people working in government, charities, and the soft drinks industry. They made lots of suggestions for things we’d missed, or needed to clarify. We changed our map and asked people to check it again. We changed it again. Only then did we decide

what we should, and could, evaluate.

|

The current version of our systems map (we still think of it as a work in progress). Larger version here.

|

Yes, we are going to look at how the price of sugary drinks changes over the next few years. But we are also going to look at the amount of sugar in soft drinks in UK supermarkets, and the range of drinks available. We’re going to use

commercial data to look at purchasing of soft drinks, as well as other sugary foods. We’ll use the

National Diet & Nutrition Survey to explore whether there are any changes in how many sugary drinks, and other sweet foods, people in the UK eat. We’ll use

hospital data to see if the number of children admitted with severe dental decay decreases. We’ll use statistical modelling to predict how changes in how many soft drinks people drink might translate into cases of diabetes and heart disease. We’ll look at the impact of the tax on jobs, and the economy. We’ll explore the ‘political processes’ of why and how this tax happened at this time. And we’ll conduct surveys to find out what people in the UK think of sugar, sugary drinks, and the tax itself – and whether this changes over time.

Obviously it’s going to be a lot of work. We’re going to need some excellent people to join the team to help us actually do this thing. Personally, I’m feeling a little overwhelmed/excited/overwhelmed/excited. It’s going to be brilliant!

Wanna

be part of it?

Comments

Post a Comment